Prepared Remarks Slated for 10:30 a.m. EST Today

PERRYSBURG, Ohio, Jan. 06, 2020 (GLOBE NEWSWIRE) — FOR IMMEDIATE RELEASE

O-I Glass, Inc. (“O-I Glass” or the “Company”) today announced that its wholly owned subsidiary, Paddock Enterprises, LLC (“Paddock”), has voluntarily filed for relief under Chapter 11 of the Bankruptcy Code in the U.S. Bankruptcy Court for the District of Delaware to equitably and finally resolve all of its current and future asbestos-related claims.

On December 27, 2019, O-I Glass announced the adoption of a new holding company structure whereby O-I Glass became the new parent entity with Owens-Illinois Group, Inc. (“O-I Group”) and Paddock as direct, wholly owned subsidiaries. The Company’s legacy asbestos-related liabilities are isolated within Paddock, structurally separating them from the Company’s glass-making operations, which remain under O-I Group. O-I Glass and O-I Group are not included in the Chapter 11 filing and will continue to operate as usual throughout Paddock’s Chapter 11 process.

Andres Lopez, CEO of O-I Glass, said, “Addressing Paddock’s legacy liabilities through Chapter 11 will help enable O-I Glass to further unlock the value creation potential of this global franchise. By improving the Company’s capital structure, this important step will support a number of critical strategic efforts and possibilities as O-I Glass leverages its position as the world’s leading manufacturer of sustainable glass packaging.”

After exiting a business in 1958 that produced Kaylo, an asbestos-containing thermal insulation product, the Company has disposed of over 400,000 asbestos-related claims and incurred gross expense of approximately $5 billion for asbestos-related costs. Lopez continued, “Paddock evaluated its options and determined that a Chapter 11 plan of reorganization was the most fair and equitable way to obtain certainty and finality in addressing its legacy asbestos-related liabilities. Pending final resolution of the Chapter 11 proceeding, all asbestos-related claims payments will be suspended.”

Paddock’s ultimate goal in its Chapter 11 case is to confirm a plan of reorganization under Section 524(g) of the U.S. Bankruptcy Code and utilize this specialized provision to establish a trust that will address all current and future asbestos-related claims. Paddock has been and remains committed to fairly and equitably compensating claimants who are ill and have legitimate exposure to the Kaylo products manufactured by its predecessor from 1948-1958. Paddock looks forward to working swiftly and constructively to confirm a plan of reorganization and is committed to emerging from bankruptcy as expediently as possible.

Additional information about the Chapter 11 case can be found at:

https://cases.primeclerk.com/Paddock Paddock is advised in this matter by Latham & Watkins LLP and Alvarez & Marsal.

Prepared Remarks Scheduled for January 6, 2020

O-I Glass CEO Andres Lopez and CFO John Haudrich will conduct a conference call to discuss these developments on Monday, January 6, 2020, at 10:30 a.m. EST. Given the court-related procedural activities initiated today with Paddock’s Chapter 11 filing, management will share prepared remarks, however the conference call will not include a question and answer session. A live webcast of the conference call, including presentation materials, will be available on the O-I Glass website, www.o-i.com/investors, in the Webcasts and Presentations section.

The conference call also may be accessed by dialing 888-733-1701 (U.S. and Canada) or 706-634-4943 (international) by 10:20 a.m. EST, on January 6, 2020. Ask for the O-I Glass conference call. A replay of the call will be available on the O-I Glass website, www.o-i.com/investors, for a year following the call.

O-I Glass news releases are available on the O-I Glass website at www.o-i.com.

O-I Glass’s fourth quarter and full year 2019 earnings conference call and webcast is currently scheduled for Wednesday, February 5, 2020, at 8:00 a.m. EST.

About O-I Glass

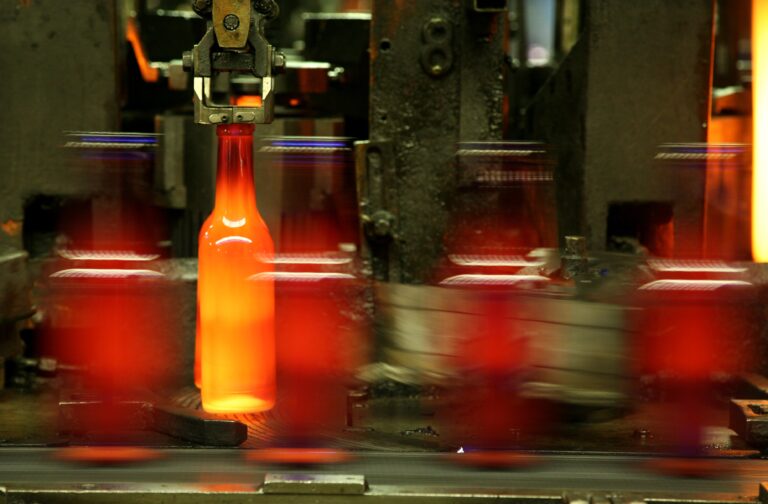

At O-I Glass, Inc. (NYSE: OI), we love glass and we’re proud to make more of it than any other glass bottle or jar producer in the world. We love that it’s beautiful, pure and completely recyclable. With global headquarters in Perrysburg, Ohio, we are the preferred partner for many of the world’s leading food and beverage brands. Working hand and hand with our customers, we give our passion and expertise to make their bottles iconic and help build their brands around the world. With more than 26,500 people at 78 plants in 23 countries, O-I Glass has a global impact, achieving revenues of $6.9 billion in 2018. For more information, visit o-i.com.

Forward-Looking Statements

This press release contains “forward-looking” statements related to O-I Glass, Inc. (“O-I Glass” or the “Company”) within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Section 27A of the Securities Act of 1933. These forward-looking statements relate to a variety of matters, including, without limitation, statements regarding the approval, consummation and potential impact of the Corporate Modernization. Forward-looking statements reflect the Company’s current expectations and projections about future events at the time, and thus involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,” “potential,” “continue,” and the negatives of these words and other similar expressions generally identify forward-looking statements.

It is possible that the Company’s future financial performance may differ from expectations due to a variety of factors including, but not limited to the following: (1) risks inherent in, and potentially adverse developments related to, the Chapter 11 bankruptcy proceeding involving the Company’s wholly owned subsidiary Paddock Enterprises, LLC (“Paddock”), that could adversely affect the Company and the Company’s liquidity or results of operations, including risks from asbestos-related claimant representatives asserting claims against the Company and potential for litigation and payment demands against us by such representatives and other third parties, (2) the potential impact of the Corporate Modernization on the Company’s branding and business, (3) the potential costs of the Corporate Modernization, (4) the Company’s ability to manage its cost structure, including its success in implementing restructuring or other plans aimed at improving the Company’s operating efficiency and working capital management, achieving cost savings, and remaining well-positioned to address the Company’s legacy liabilities, (5) the Company’s ability to acquire or divest businesses, acquire and expand plants, integrate operations of acquired businesses and achieve expected benefits from acquisitions, divestitures or expansions, (6) the Company’s ability to achieve its strategic plan, (7) foreign currency fluctuations relative to the U.S. dollar, (8) changes in capital availability or cost, including interest rate fluctuations and the ability of the Company to refinance debt at favorable terms, (9) the general political, economic and competitive conditions in markets and countries where the Company has operations, including uncertainties related to Brexit, economic and social conditions, disruptions in the supply chain, competitive pricing pressures, inflation or deflation, and changes in tax rates and laws, (10) the Company’s ability to generate sufficient future cash flows to ensure the Company’s goodwill is not impaired, (11) consumer preferences for alternative forms of packaging, (12) cost and availability of raw materials, labor, energy and transportation, (13) consolidation among competitors and customers, (14) unanticipated expenditures with respect to data privacy, environmental, safety and health laws, (15) unanticipated operational disruptions, including higher capital spending, (16) the Company’s ability to further develop its sales, marketing and product development capabilities, (17) the failure of the Company’s joint venture partners to meet their obligations or commit additional capital to the joint venture, (18) the ability of the Company and the third parties on which it relies for information technology system support to prevent and detect security breaches related to cybersecurity and data privacy, (19) changes in U.S. trade policies, and the other risk factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 and any subsequently filed Quarterly Reports on Form 10-Q or the Company’s other filings with the Securities and Exchange Commission.

For further information, please contact:

Chris Manuel

Vice President, Investor Relations

567-336-2600

[email protected]

###

Attachments