Global Business Continues to Operate Without Interruption; Recent Demand Patterns Remain Stable

PERRYSBURG, Ohio, March 11, 2020 (GLOBE NEWSWIRE) — FOR IMMEDIATE RELEASE

O-I Glass, Inc. (NYSE: OI) today provided a business update in lieu of management’s previously scheduled presentation at the JP Morgan investor conference which was cancelled by the organizers due to COVID-19. Additionally, a presentation originally intended for the conference that is primarily focused on the longer term strategy of the business has been posted on its website at www.o-i.com.

“O-I’s operating performance through February has been solid, and pacing in-line with the company’s most recent earnings guidance for the first quarter of 2020. Overall, sales volume has been flat with the prior year. Higher shipments in Asia-Pacific (including China) and the benefit from the Nueva Fanal acquisition offset continued lower beer demand in North America which has been in-line with our expectations. We benefited from higher average selling prices as well as favorable sales mix and cost performance, especially at the company’s focus factories. We are pleased with the progress of our turnaround initiatives and overall business performance to date,” said Andres Lopez, CEO.

Lopez continued, “Despite the challenges associated with COVID-19 and resulting economic disruption, O-I’s business continues to operate without interruption and recent demand patterns remain stable through early March. O-I continues to closely follow guidance from the World Health Organization, U.S. Centers for Disease Control and Prevention as well as federal and state governments in appropriate jurisdictions related to COVID-19. The company has been working with customers and suppliers alike to develop preparedness plans in response to this rapidly evolving situation. We are better integrated as an enterprise and prepared than ever to move with speed and agility to execute any contingency plans if required.”

CFO John Haudrich added, “O-I continues to advance its strategic portfolio review, as expected, and the company’s balance sheet is sound. Following refinancing activity last year and given proceeds from recent divestitures, the company’s liquidity position is strong with cash and available lines of credit of approximately $2 billion at December 31, 2019 and no near-term bond maturities. Year-to-date through February 2020, cash flows compare favorably to the same period last year given lower working capital levels, lower capital expenditures and suspension of asbestos related payments. The Chapter 11 process of O-I’s subsidiary Paddock Enterprises is proceeding as expected. Paddock has opposed a request by the U.S. Trustee to examine its Corporate Modernization transaction, which is a strategy that has been widely and successfully used by other companies and which we believe enhances Paddock’s ability to resolve its liabilities fairly and in way that maximizes value for all stakeholders. We are confident that the Corporate Modernization transaction fully complies with Delaware law and will be validated through the bankruptcy process. Paddock remains committed to addressing its legacy liabilities in a just and appropriate manner and is continuing work with its creditor constituencies towards achieving a consensual Plan of Reorganization.”

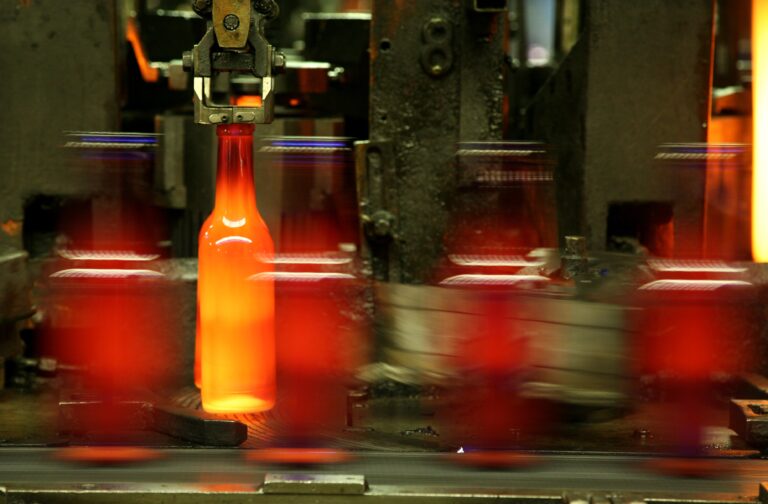

About O-I Glass

At O-I Glass, Inc. (NYSE: OI), we love glass and we’re proud to make more of it than any other glass bottle or jar producer in the world. We love that it’s beautiful, pure and completely recyclable. With global headquarters in Perrysburg, Ohio, we are the preferred partner for many of the world’s leading food and beverage brands. Working hand and hand with our customers, we give our passion and expertise to make their bottles iconic and help build their brands around the world. With more than 27,500 people at 78 plants in 23 countries, O-I has a global impact, achieving revenues of $6.7 billion in 2019. For more information, visit o-i.com.

Forward-Looking Statements

This press release contains “forward-looking” statements related to O-I Glass, Inc. (“O-I Glass” or the “company”) within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and Section 27A of the Securities Act of 1933. Forward-looking statements reflect the company’s current expectations and projections about future events at the time, and thus involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,” “potential,” “continue,” and the negatives of these words and other similar expressions generally identify forward-looking statements.

It is possible that the company’s future financial performance may differ from expectations due to a variety of factors including, but not limited to the following: (1) the company’s ability to obtain the benefits it anticipates from the Corporate Modernization, (2) risks inherent in, and potentially adverse developments related to, the Chapter 11 bankruptcy proceeding involving the company’s wholly owned subsidiary Paddock Enterprises, LLC (“Paddock”), that could adversely affect the company and the company’s liquidity or results of operations, including risks from asbestos-related claimant representatives asserting claims against the company and potential for litigation and payment demands against us by such representatives and other third parties, (3) the company’s ability to accurately estimate its total asbestos-related liability or to control the timing and occurrence of events related to outstanding asbestos-related claims, including but not limited to the company’s obligations to make payments to resolve such claims under the terms of its support agreement with Paddock, (4) the company’s ability to manage its cost structure, including its success in implementing restructuring or other plans aimed at improving the company’s operating efficiency and working capital management, achieving cost savings, and remaining well-positioned to address the company’s legacy liabilities, (5) the company’s ability to acquire or divest businesses, acquire and expand plants, integrate operations of acquired businesses and achieve expected benefits from acquisitions, divestitures or expansions, (6) the company’s ability to achieve its strategic plan, (7) foreign currency fluctuations relative to the U.S. dollar, (8) changes in capital availability or cost, including interest rate fluctuations and the ability of the company to refinance debt at favorable terms, (9) the general political, economic and competitive conditions in markets and countries where the company has operations, including uncertainties related to Brexit, economic and social conditions, disruptions in the supply chain, competitive pricing pressures, inflation or deflation, changes in tax rates and laws, natural disasters, weather, pandemics and outbreaks of contagious diseases and other adverse public health developments, such as COVID-19, (10) the company’s ability to generate sufficient future cash flows to ensure the company’s goodwill is not impaired, (11) consumer preferences for alternative forms of packaging, (12) cost and availability of raw materials, labor, energy and transportation, (13) consolidation among competitors and customers, (14) unanticipated expenditures with respect to data privacy, environmental, safety and health laws, (15) unanticipated operational disruptions, including higher capital spending, (16) the company’s ability to further develop its sales, marketing and product development capabilities, (17) the failure of the company’s joint venture partners to meet their obligations or commit additional capital to the joint venture, (18) the ability of the company and the third parties on which it relies for information technology system support to prevent and detect security breaches related to cybersecurity and data privacy, (19) changes in U.S. trade policies, and the other risk factors discussed in the company’s Annual Report on Form 10-K for the year ended December 31, 2019 and any subsequently filed Annual Report on Form 10-K, Quarterly Reports on Form 10-Q or the company’s other filings with the Securities and Exchange Commission.

It is not possible to foresee or identify all such factors. Any forward-looking statements in this document are based on certain assumptions and analyses made by the company in light of its experience and perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance and actual results or developments may differ materially from expectations. While the company continually reviews trends and uncertainties affecting the company’s results or operations and financial condition, the company does not assume any obligation to update or supplement any particular forward-looking statements contained in this document.

Attachment

For more information, contact:

Chris Manuel

Vice President of Investor Relations

567-336-2600

[email protected]